In India, a ‘block deal’ is a large trade executed in a single transaction with a minimum value of INR 25,00,00,000, during separate trading windows as provided by the stock exchange.

The Securities & Exchange Board of India vide its circular dated 8 October 2025 (Circular) introduced certain amendments to India’s block deal framework. The Circular takes effect from the 60th day of its issuance, i.e. 7 December 2025, and applies to the block deal window under the T+0 settlement cycle as well.

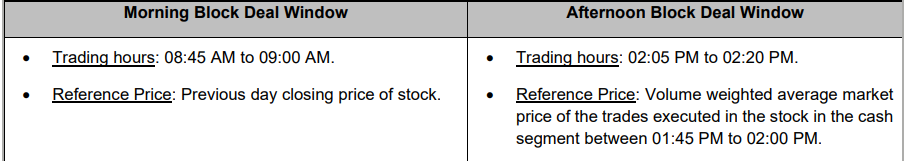

An overview of the modified Indian block deal framework is provided below.

Block Deal Windows

Key Features

- In lieu of ±1%, orders to now be placed within ±3% of the applicable reference price in the respective windows, subject to surveillance measures and applicable price bands.

- The minimum order size for trades has been increased from INR 10,00,00,000 to INR 25,00,00,000.

- Every trade must result in delivery and shall not be squared off or reversed.

- Stock exchanges to disseminate information on block deals to the public on the same day, post the market hours.

Bharucha & Partners – Vandana Pai